We know that Due date for TDS is 7th of next month

However for March,TDS Due date is 30 April

- Excel based Income Tax Calculator for FY 2019-20 – AY 2020-21. This excel-based Income tax calculator can be used for computing income tax on income from salary, pension, gifts, fixed deposit and bank interest, house rent and capital gains (short and long term gains).

- Save a data source. In Tableau Desktop, open the workbook that has the connection to the data you want to save as a file. At the top of the Data pane, right-click (Control-click on Mac) the name of the data source, and then select Add to Saved Data Sources. Enter a file name, select the file type (.tds or.tdsx), and then click Save.

If deposited late,we have to pay interest @ 1.5%

For TDS Calculation Sheet relevant for F.Y. 2017-18 and Asst.Year (A.Y.) 2018-19 Scroll to the End of this Post where you will find various links to download the Sheet using which you can Calculate TDS applicable. Or else to known the Latest Amendments for the person having salary income, Slab rates, importance of TDS and much more keep reading.

If TDS is deposited late

Interest is payable from

Date of Deduction (and not Last Date of Challan)

to

Actual Date of Deposit

@ 1.5%

Changes in Interest Rate due to lockdown, If TDS Late Deposit

However,Due to Lockdown,Government has temporarily reduced Rate by 50%

| Current Rate | New Rate (Temporary) | |||||||

| Interest Rate on Late Deposit of TDS | 1.50% | 1.5%*50%=0.75% | ||||||

Due between 20 Mar 2020 to 29 June 2020,

if paid by 30 June 2020

Example 1

Bill of 20 October received of 50000 of Maintenance Charges

Payment made on 24 Oct of 49000(50000-2% tds)

What is Date of Deduction?

Date of Deduction is

Earlier of

Bill -->20 Oct

or

Payment-->24 Oct

i..e 20 Oct

What is date of Deposit?

Date of Deposit is 7th of Next month of Deduction

i.e. 7 November

Suppose TDS Actually deposited on 8 November

What is Interest to be paid?

Interest is to be calculated from 20 Oct to 8 November

This will count as 2 months (October and November)

Interest Rate =1.5%

Interest Amount=1000*1.5%*2=Rs 30

Note

If TDS of March late deposited,then 3 Months Interest Payable

1.5%*3=4.5%

Example 2

Bill of 29 March received of 50000 of Maintenance Charges

Payment made on 30 March of 49000(50000-2% Tds)

What is Date of Deduction?

Date of Deduction is

Earlier of

Bill -->29 March

or

Payment --->30 March

i.e 29 March

What is date of Deposit?

Date of Deposit is 30 April for March TDS Non Salary

Suppose TDS Actually deposited on 1 May

What is Interest to be paid?

Interest is to be calculated from 29 March to 1 May

This will count as 3 months (March,April and May)

Interest Rate =1.5%

Interest Amount=1000*1.5%*3=Rs 45

I have prepared salary break-up for an employee in my organization inline with the salary break-up of other employees. His basic is 22667 and HRA is 11333, so the gross is 34000. We only deduct PF amount i.e 780/-. Please help me in calculating the TDS amount from his salary and how to reduce this amount. And tell me how TDS calculation is done in detail.

Thanks

Neetu

From India, Delhi

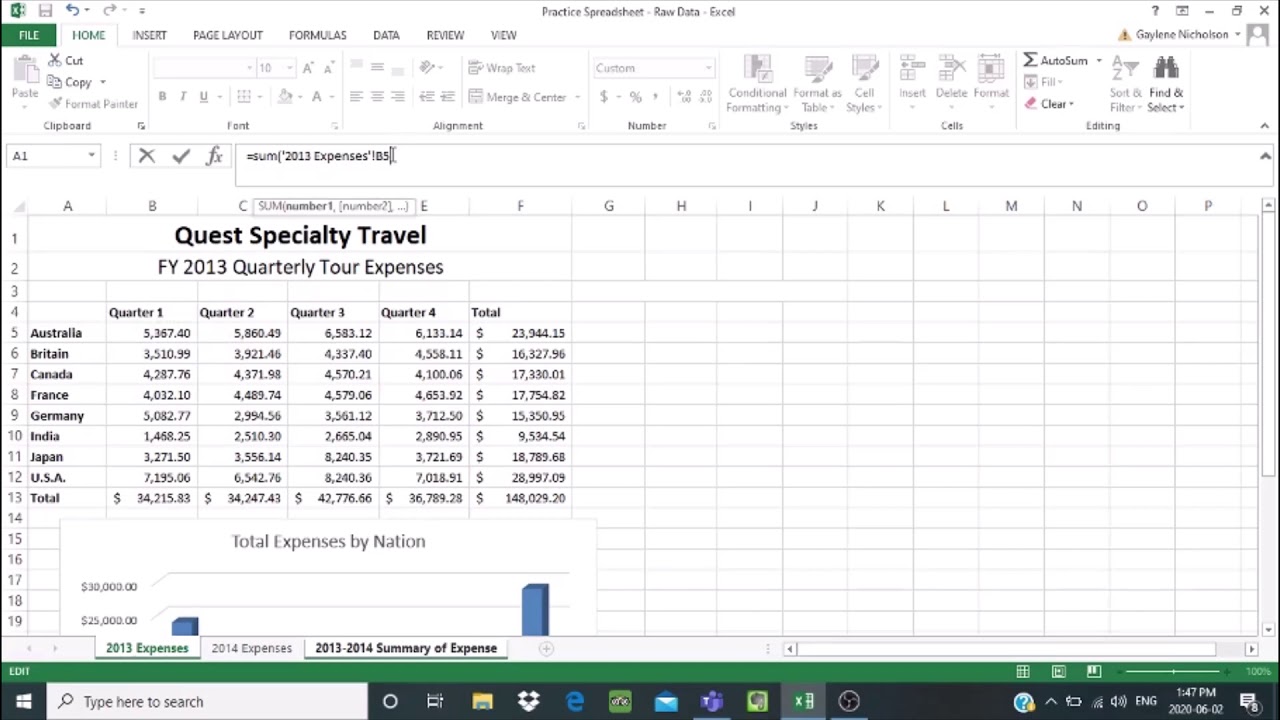

Tds Calculation Sheet In Excel Format 2019-20

From India, Madras

| TDS CAL1.xls (19.5 KB, 6704 views) |

Here by i am sending the 2 formats for TDS Calculation for Male and Female. You can calculate TDS for yearlywise and divided by 12 months. You can get the monthly TDS.

Thanks & Regards

Raju Akula.

929 010 5007

From India, Hyderabad

| Male Format.xls (25.0 KB, 3275 views) |

| Female Format.xls (25.5 KB, 1076 views) |

HRA shown above is 50%. It is the maximum limit to be exempted. To get full exemption on HRA, House rent receipt @60% (Actual HRA + 10%) is to be furnished. i.e 11333+2267= 13600.

Balance salary is 22667x12 = 2,72,004 -(1).

Savings towards PF, 780x12 = 9360 - (2)

Taxable income (1)-(2) = 2,62,644

In case of Male Employee, Tax = (2,62,644-1,60,000)x10% = 10264.4

For Female, additional exemption of 3000 on tax is applicable.

For further deduduction on Tax, there are various provisions as detailed under.

I shall insert an Excel worksheet (but comparitively simple) for Income Tax Calculation on salary for the Financial Year 2010-11 (Assessment Year 2011-12). Prior to that I wish to explain some details to get an idea to enter the inputs.

On gross salary the following deductions are applicable.

1) Professional Tax

2) House Rent in excess of 1/10th of salary subject to ceiling equivalent to HRA

3) Interest on Housing loan subject to ceiling Rs. 1,50,000.

4) Refund on Housing loan, savings, tution fee to 2 children etc. altogether subject to ceiling Rs.100,000.

5) In addition savings on infrastructure bonds upto Rs. 20,000.

6) Other than the above one lakh, 15000 to 20000 towards medi claim premium, 40000 to 60000 towards treatment on specified diseases like Motor Neuron disease, 75000 to 100,000 towards disabilty etc. are also admissible for deduction.

The details can be obtained from following web site.

CENTRAL GOVERNMENT EMPLOYEES NEWS: New Income Tax Slab for FY 2010-11

Now taxable income can be calculated as follows.

Gross salary - total deductions = Taxable income

Tax payee can be categorised into 3.

1) Non Seniors - Male

2) Non Seniors - Female

3) Senior Citizens (65 years old & above)

If the taxable income is Rs. 2,40,000, a Senior Citizen is fully exempted from paying tax. Non Senior Female has to pay in excess of Rs.1,90,000 & Non Senior Male in excess of Rs.1,60,000.

Beyond the above income, one has to pay 10% upto Rs.5,00,000, 20% there after upto Rs.8,00,000 and 30% in excess of Rs.8,00,000. In addition, an education cess @ 3% will be charged on Total Tax.

I shall quote on example.

Gross income of a Non Senior Male - Rs. 12,00,000

Deductions (actual) : Professional Tax - 12000, Housing loan interest - 2,00,000, Total savings/deductions - 2,50,000, Savings on Infrastructure bond - 25,000, other deductions over 1,00,000 - 50,000.

Admissible total deductions (subject to ceiling limits) - 12000+150000+100000+20000+50000 = 332000

Taxable income, 1200000 - 332000 = 868000

For Non Senior Male :

Rs. 1,60,000 is exempted.

For next 340000 (500000-160000), 340000x10% = 34000 -(1)

For next 300000 (800000-500000), 300000x20% = 60000 -(2)

For next 68000 (868000-800000), 68000x30%= 20400 -(3)

Tax - (1)+(2)+(3) = 114400

Also For Non Senior Female Tax is, 114400-3000 = 110400

and Senior Citizens Tax is, 114400-8000 = 106400

Education Cess, 114400*3% = 3432.

Total Tax - Rs. 1,17,832

See Excel Sheet. Enter gross salary and deductions/savings applicable in green colour column. Results will be occured in yellow colour. The red colour is used for static datas.

ABBAS.P.S,

Secretary,

ITI Employees' Association ,

ITI Ltd, PALAKKAD - 678 623,

KERALA, INDIA.

Ph. +91 9447 467 667

From India, Bangalore

| Income Tax Calculator.xls (17.0 KB, 1615 views) |

From India, Kolkata